unlevered free cash flow yield

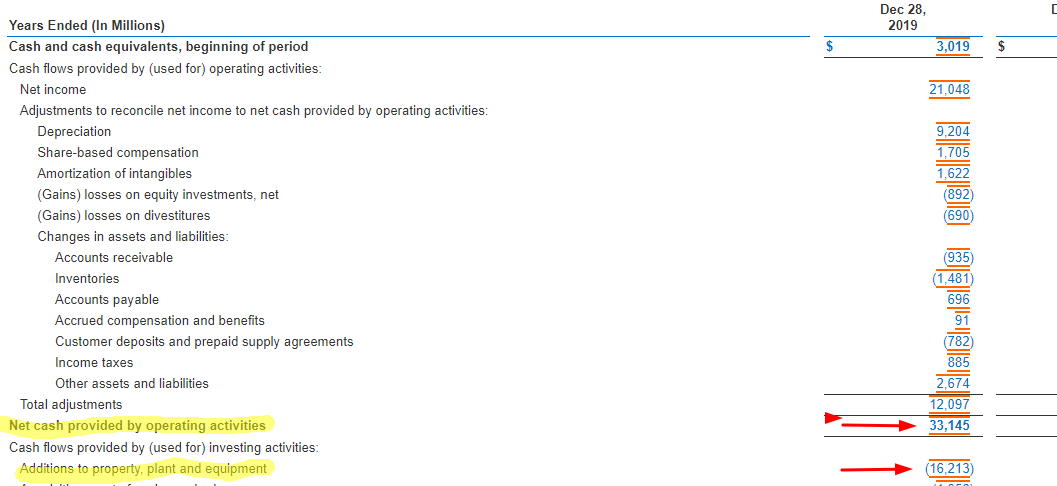

Note a few takeaways here. FCFF EBIT - Taxes Depreciation Amortization - Change in Working Capital -.

Unlevered Free Cash Flow Ufcf Lumovest

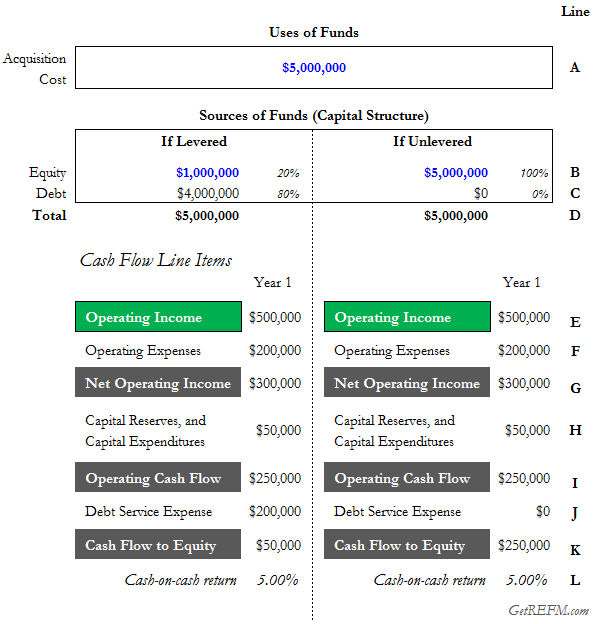

Based on these projections the unleveraged IRR calculation is 989 and the cash-on-cash return averages 2062 but this is skewed higher by the sale of the property.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

. UFCF EBITDA CAPEX working capital taxes. LFCF 1176 586 62 69 80 1009. Hence using unlevered cash flow gives a much better estimate of the value a business generates by avoiding the effects of its capital structure.

Putting this all together the formula has been shown below. The formula for UFCF is. How to calculate unlevered free cash flow.

If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV. A higher free cash flow yield is better because then the company is generating more cash and has more money to pay out dividends pay down debt and re-invest into the company. Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working capital - taxes.

As you can see the equation for unlevered free cash flow is not nearly as extensive as the one for levered free cash flow. Therefore youll find that unlevered free cash flow is higher than levered free cash flow. LFCF yield is calculated as levered free cash flow divided by the value of equity.

Unlevered Free Cash Flow - UFCF. Levered free cash flow assumes the business has debts and uses borrowed capital. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization.

The formula for unlevered free cash flow also known as free cash flows to firm FCFF is. It is mechanically similar to thinking about the dividend or earnings yield of a stock. FCF Yield Unlevered Free Cash Flow Total Enterprise Value Applying this formula Inari Amertron Berhads FCF Yield is calculated below.

A company with debt will have a higher unlevered FCF yield than a levered FCF yield. This metric is unlevered meaning that it does not take into account the companys debt load. The formula to calculate UFCF is.

Where UFCF Unlevered free cash flow. As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less an increase in non-cash working capital of 14000 less capital expenditures of 40400 results in unlevered free cash flow of -48560. FCF yield is also known as Free Cash Flow per Share.

LFCF -346 million. The continuous decline in free cash flow may impact future earnings growth. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O. Free Cash Flow to Firm FCFF NOPAT DA Change in NWC CapEx. LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value.

Unlevered free cash flow UFCF is an important metric for assessing a companys financial health and its ability to generate cash flow. LFCF refers to levered free cash flow the final amount that you are aiming to prove. Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value.

Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator. Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds. The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided.

CapEx and increases in NWC each represent outflows of cash which means less free cash flow remains post-operations for payments related to servicing interest debt amortization etc. A lower free cash flow yield is worse because that means there is less cash available. Theoretically the capital could be generated either through debt or through equity.

In year 10 the large cash flow represents the income from operations plus the proceeds from the sale of the property the reversion cash flow. ΔNWC signifies the change in net working capital which is a difference of assets and liabilities. Unlevered Free Cash Flow UFCF Formula.

The unlevered cost of capital is the implied rate of return a company expects to earn on its assets without the effect of debt. Unlevered free cash flow can be reported in a companys. Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to.

UFCF is calculated as net income plus depreciation and amortization minus capital expenditures. A company that wants to undertake a project will have to allocate capital or money for it. More issuances of debt would actually increase levered free cash flow in the short term but would also cripple levered free cash flow in the long term or eventually.

A lower free cash flow yield is worse because that means there is less cash. Thats because the levered free cash flows equation subtracts debt and equity to yield operating cash only while unlevered free cash flows do not. Unlevered Free Cash Flow RM3781 M Total Enterprise Value RM9363 B FCF Yield 40.

A negative free cash flow yield or negative free cash flow may indicate that the firm is not liquid enough and would need external funding to continue its operations. The weighted average cost of capital. UFCF EBITDA - CapEx - Changes in WC - Taxes.

CAPEX refers to capital expenditures including investments in building. Definition of Unlevered Free Cash Flow Yield Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value. 1 0 Y A F C F O S O W P S P L C A I where.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Explained

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling